When you think of foreign exchange laws, you might imagine endless paperwork, legal jargon, and complicated restrictions. But here’s the truth: India’s shift from FERA to FEMA was not just a change in legislation; it was a pivotal moment that helped open the country to the global economy. Whether you are a student, a finance enthusiast, or a young professional, understanding FEMA is crucial to grasping how India became one of the most attractive investment destinations in the world.

Back in the 1970s, India was struggling with a severe balance of payments crisis. Foreign currency was scarce, and the government was extremely cautious about money leaving the country. To manage this, the Foreign Exchange Regulation Act (FERA) was enacted in 1973.

FERA was extremely restrictive. Almost every foreign exchange transaction required prior approval from authorities. Violations were treated as criminal offences, often involving prosecution and jail time. Unsurprisingly, this created an atmosphere of fear and uncertainty among foreign investors. The message was clear, India was not ready to play on the global financial stage.

Under FERA, even simple business transactions with foreign entities were difficult. The system was designed to protect the economy but ended up discouraging innovation, slowing down trade, and cutting India off from valuable global capital and technology.

In the 1990s, India faced another economic crisis, but this time, the response was very different. The government-initiated liberalisation policies, opening up the economy and encouraging global trade. But FERA, with its outdated approach, no longer fit the picture.

That is where FEMA came in. The Foreign Exchange Management Act was passed in 1999 and came into effect in 2000. Unlike its predecessor, FEMA aimed to manage and not restrict foreign exchange. It focused on facilitating external trade, encouraging foreign investment, and ensuring the stability of India’s currency markets.

One of the most significant changes was that violations under FEMA were treated as civil offences rather than criminal ones. This simple shift in tone and approach sent a powerful message to the global investment community: India was open for business.

FEMA classifies foreign exchange transactions into two main types: Current Account Transactions and Capital Account Transactions.

Current Account Transactions involve everyday activities such as payments for imports and exports, remittances for education or medical treatment abroad, and interest or dividend payments. These transactions are generally permitted unless specifically restricted by the government.

On the other hand, Capital Account Transactions relate to investments, loans, and property acquisitions that affect the assets or liabilities of Indian residents abroad or foreign residents in India. These are more strictly regulated and typically require prior approval from the Reserve Bank of India or the government.

This structure ensures that routine, essential transactions remain hassle-free while maintaining oversight over significant cross-border movements of capital.

FEMA also introduced the concept of "Authorised Persons", i.e. individuals or institutions approved by the Reserve Bank of India to deal in foreign exchange. These include banks, money changers, and certain financial institutions.

They are classified into three categories. Category I includes banks that can handle all types of foreign exchange transactions. Category II includes money changers who are allowed to deal in cash and traveller’s cheques. Category III includes offshore banking units with limited permissions.

These intermediaries help ensure that all foreign exchange dealings comply with the law while making it easier for the public to engage in such transactions.

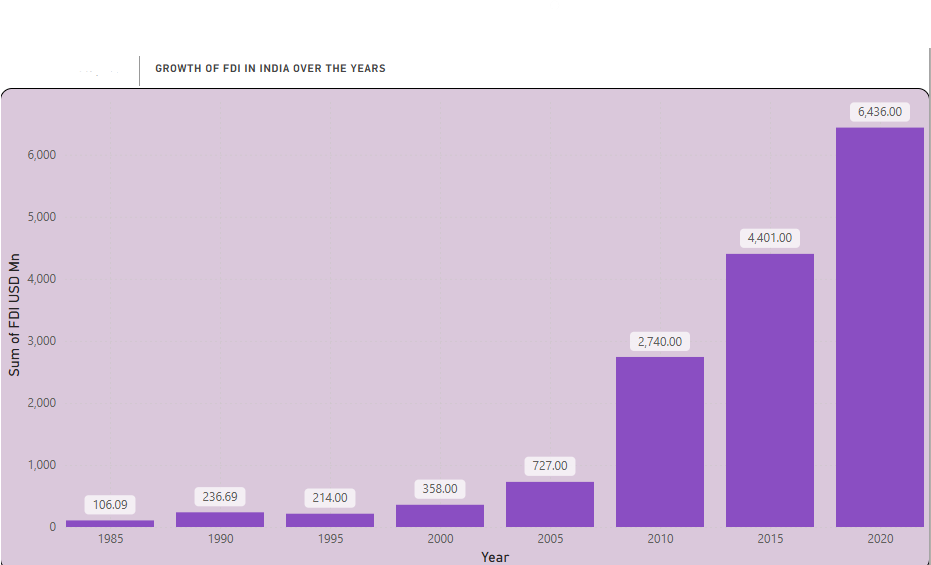

The most visible impact of FEMA has been its role in attracting foreign investment into India. It has helped streamline the process for both Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI).

Under FEMA, foreign investors can invest through two main routes: the Automatic Route, which does not require prior approval for most sectors, and the Government Route, which is applicable to more sensitive sectors like defence or telecom

This clarity and openness have paid off. In 1990, foreign direct investment into India stood at a mere 1.5 billion US dollars. By 2023, that figure had grown to nearly 82 billion US dollars. Such a dramatic rise would not have been possible under FERA’s rigid system.

FEMA’s investor-friendly approach also made it easier for companies to invest abroad. Indian entities can now make outbound investments under well-defined limits and routes, such as the Liberalised Remittance Scheme, creating global business opportunities for Indian firms. The same can be observed with the growth of India’s GDP over the years which has been accelerated with the inflow of foreign capital

| Year | GDP (USD Bn) |

|---|---|

| 1999 | 466.87 |

| 2004 | 721.49 |

| 2009 | 1365.37 |

| 2014 | 2039.13 |

| 2019 | 2835.61 |

| 2024 | 3909.10 |

| IKEA’s Entry into India | PC Financial Services (Cashbean App) |

|---|---|

|

Thanks to FEMA’s guidelines for single-brand retail, IKEA was allowed to invest 100 percent in its Indian venture. The only condition was that at least 30 percent of the goods had to be sourced locally. IKEA not only complied but also invested in local artisans and supply chains, creating jobs and boosting the domestic retail ecosystem. |

Not all stories end well. PC Financial Services was found to have transferred large sums of money to foreign entities without proper RBI approval. These transactions violated FEMA’s rules on capital account transactions. As a result, its licence was cancelled, and assets were seized. One of the most significant changes was that violations under FEMA were treated as civil offences rather than criminal ones. This simple shift in tone and approach sent a powerful message to the global investment community: India was open for business. |

FEMA is more than just a law, it is the foundation of India’s foreign exchange ecosystem. It balances the need to attract foreign investment with the responsibility to protect national interests. It offers clarity to investors, ensures compliance with global standards, and supports India’s goal of becoming a globally competitive economy.

Most importantly, it continues to evolve, adapting to the changing needs of the Indian economy and global financial trends.

If you are a student, aspiring economist, finance professional, or just curious about how India interacts with the world financially, FEMA is an essential concept to understand. It teaches us how thoughtful legislation can change a country’s economic destiny, from suspicion and control to openness and growth.

Next time you hear about a global company setting up shop in India, or a young entrepreneur investing abroad, know that FEMA is quietly working in the background, making it all possible.

CA Dikshit Jain – Partner – dikshit@jdpco.in

Disha Sharma – Intern (Paper Presenter) – disha@jdpco.in

This blog is based on extracts from a technical paper presented at "Pravaha – CA Students National Conference 2025" held in Hyderabad on 12th and 13th June 2025. The conference witnessed participation from over 2,000 attendees, and the paper was among the top 12 selected for final presentation.